private placement life insurance canada

Private placement life insurance webinar. The worlds leading private placements event.

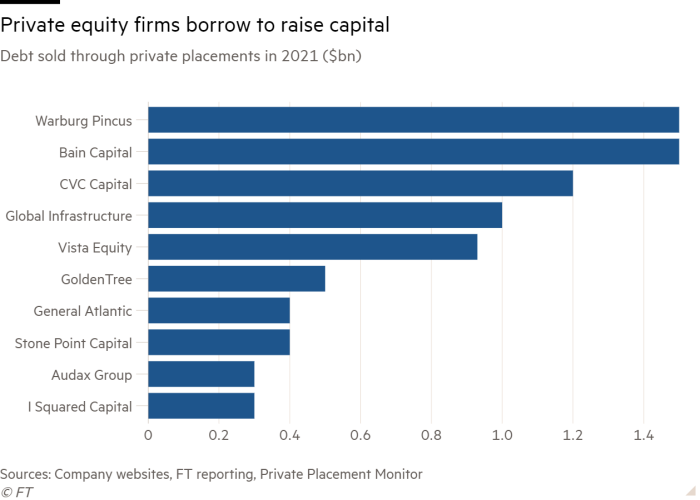

Private Equity Sidesteps Ipo Parade By Borrowing Billions Financial Times

The little-known advantages of private-placement life insurance.

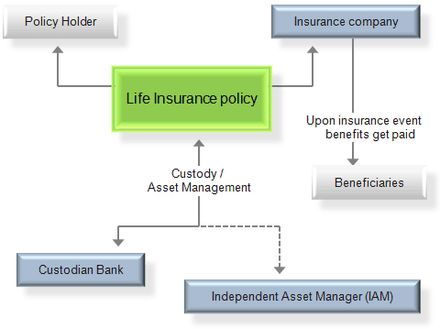

. Private placement life insurance PPLI. What Is Private Placement Life Insurance. Universal life insurance is a type of permanent life insurance that ties your cash value growth in the policy to one or more investment accounts.

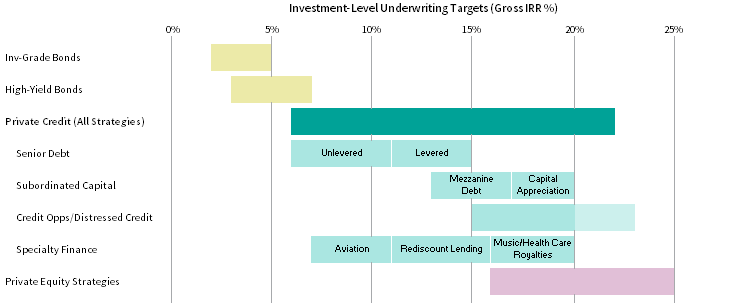

PPLI encompasses a broad range of specific life insurance and annuity policies that typically have large face amounts and underlying investments that include private placement securities such as hedge funds private equity or other alternative investment categories such as commodities or real estate. Private Placement Life Insurance PPLI is a variable universal life insurance product designed for high net worth investors. Our typical investment ranges from.

Private Placement Life Insurance can be a very powerful solution for the right client and typically they have to have. PPLI offers several advantages compared to standard policies. Private placement life insurance With PPLI a thorough underwriting process is required.

At the same time PPLI offers a tax-free death benefit payout that creates a de facto step-up in basis eliminating the taxes on any gain. Private placement life insurance PPLI is a niche solution designed for wealthy individuals who want to invest in hedge funds but avoid the associated high tax rates. PPIF offers you the opportunity to hold a years worth of meetings over 3 days.

Private Placement Life Insurance PPLI is a sophisticated vehicle that acts as an insurance policy that provides death benefit coverage while at the same time allowing for a variety of registered and non-registered investment options and a potential for significant growth in cash surrender value in a tax-efficient manner. For some taxpayers however private placement life insurance PPLI may hold another solution. Private Placement Life Insurance PPLI PPLI is an institutionally priced variable universal life insurance policy intended for accredited investors and qualified purchasers as defined under.

Where private placement deals are done Meet 570 issuers investors agents and advisors at the worlds largest private. Page 1 of 1 46-5055Z EL 1220. Private placement life insurance PPLI is a variable life policy which is not registered with SEC PPLI includes unregistered investment subaccount options in addition to registered investment subaccounts typically available in registered variable life VUL policies.

Private placement life insurance ppli is a niche solution designed for wealthy individuals. A specialized team in Toronto manages a diversified portfolio of private placements. Private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a.

Private Placement Life Insurance. PPLIs are structured as variable universal life insurance policies. Private placement life insurance and annuities own hedge funds alternatives inside tax-advantaged insurance programs learn more private placement life insurance and annuities combines the strength of premium investment products like hedge funds with the tax benefits of life insurance.

Private placement life insurance is a type of universal life insurance. Because of their considerable assets high-net-worth clients often have a greater need for and greater access to specialized financial products. The ability to fund 20m or more in premiums for several.

Private placement life insurance or PPLI is a customized version of variable rate insurance not available to the general public. Life Insurance Activity Closes 2021 With. Canada Life and design are trademarks of The Canada Life Assurance Company.

It is offered by both domestic and foreign insurance companies and provides policy holders with sophisticated asset management choices. As a high net-worth investor you know how taxes can significantly reduce. A high Net Worth.

The Great-West Life Assurance Company London Life Insurance Company and The Canada Life Assurance Company have become one company The Canada Life Assurance Company. A perfect case in point. Often shortened to PPLI Private Placement Life Insurance was originally designed for those who want to invest in hedge funds For wealthy investors in a high tax bracket who want to invest their money anyway it often makes sense to have their money within a privately placed life insurance policy to avoid individual taxes and other fees and penalties.

A twist on variable-rate universal life insurance PPLI policies are more often offered by banks. An overview of the current lay of the land in ppli. The underwriting process is both financial and medical includes a physical examination and a comprehensive review of the insureds recent medical history.

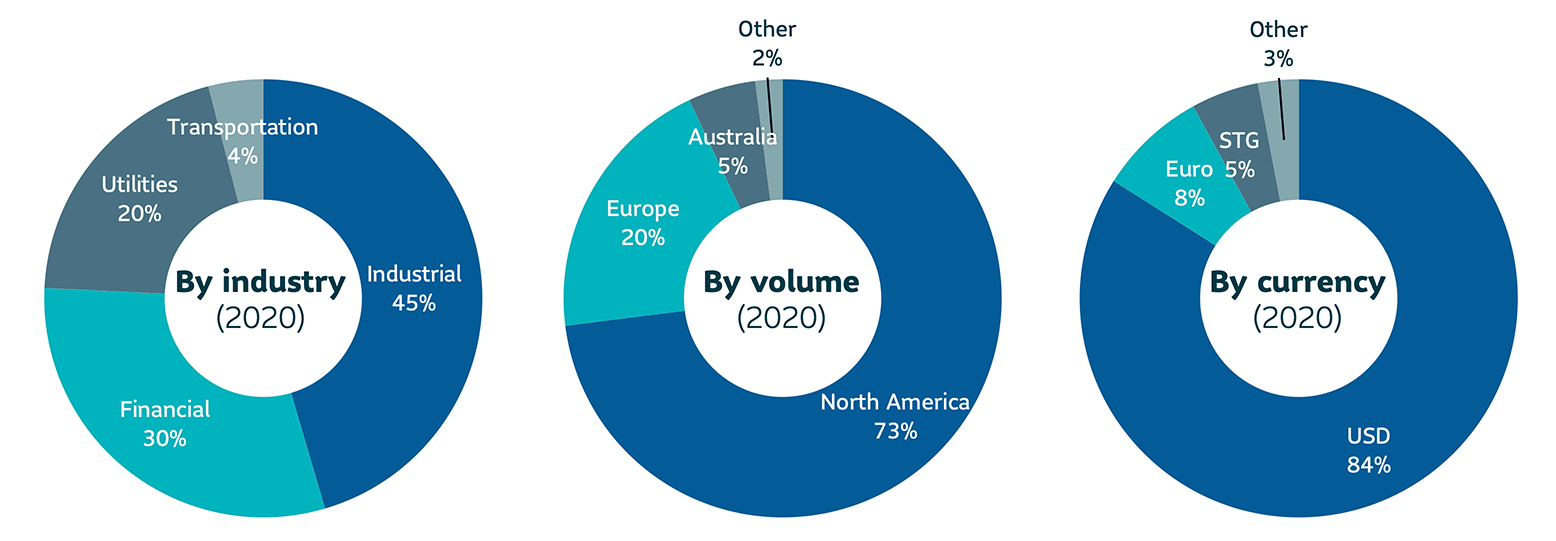

Private Placement Life Insurance Growing In Popularity Lion Street Study Says Corporate Reputation A Top Motivator For ESG Interest Survey Shows US. Private placement life insurance PPLI in contrast is a privately negotiated life insurance contract between insurance carrier and policy owner. Private placements are bond investments made through private agreements with various borrowers.

Gain direct access to attendees from across the private placement value chain at the worlds largest deal-making event. Key benefits of PPLI compared to traditional. As a member of a club deal with a small number of investors or as purchasers of broadly marketed private placements.

Private Placement Life Insurance Growing In Popularity Lion Street Study Says Corporate Reputation A Top Motivator For ESG Interest Survey Shows US. As part of a life insurance policy assets may grow tax deferred during the insureds lifetime. Investments by term Millions Percentage.

Private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. What is Private Placement Life Insurance.

Private Placement Life Insurance Wikiwand

Parental Leave Checklist For Expecting Moms And Dads Maternity Leave Planning Parental Leave Expecting Moms

Canadian Venture Capital Private Equity Association Cvca

What Is A Private Placement Youtube

Law Firm For Private Equity And Pension Fund Investments

How To Complete A Private Placement

Investment Grade Private Credit Recap And Outlook

As The Stock Market Becomes Volatile And Unpredictable People Are Seeking Safe Investment Methods At Such A Time Alt Financial Planning How To Plan Financial

Private Placement Life Insurance Ppli The Who What Where And Why Not And How Much Lake Street Advisors

Law Firm For Private Equity And Pension Fund Investments

Latest Research Perspectives Cambridge Associates

Private Equity International Pei Global Private Equity News Analysis

Private Placement Life Insurance Explained Wealth Management

Jimmy Howe Private Equity Associate Northleaf Capital Partners Linkedin

Private Equity International Pei Global Private Equity News Analysis

Private Equity Sidesteps Ipo Parade By Borrowing Billions Financial Times

Q A Frozen Cash Value Unfrozen Nature Waterfall South Tyrol

Private Equity International Pei Global Private Equity News Analysis